south carolina inheritance tax 2021

In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40. Over 20 years in business thousands of happy customers five star review rating.

However the state does have its own.

. Sep 29 2021 You can contact us at 215. Only six states impose an inheritance tax in 2022 describing it as a tax on the privilege or right of receiving property but the list is shrinking. Creating a will is oftentimes the first step that South Carolina residents must take in estate planning.

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. South Carolina does not assess an inheritance tax nor does it impose a gift tax. South Carolina has no estate tax for decedents dying on or after January 1 2005.

Writer must be of. On June 16 2021 the governor signed SF 619 which among other tax law changes reduces the inheritance tax rates by twenty percent each year beginning January 1 2021 through. Apr 05 2022 As with most tax laws so-called death taxes are hotly debated.

South Carolina Income Tax Calculator 2021. South Carolina Income Tax Range. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025.

These gifts to beneficiaries are not subject to income tax but can be subject to capital gains tax. Inheritance tax usually applies if the decedent lived in one of those six states or if the property being passed on is located in one of. South Carolina inheritance tax and gift tax.

2021 South Carolina State Income Tax Return forms for Tax Year 2021 Jan. Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. In January 2013 Congress set the estate tax exemption at 5000000 for decedents dying in 2011 and indexed it to inflation.

31 2021 can be e-Filed with your Federal Income Tax Return until April 18 2022. In other words you can make up to 16000-worth gifts to as many people as you. The lawyers at King Law can help you plan for what happens after youre gone and were here to help you get a better sense of where you stand.

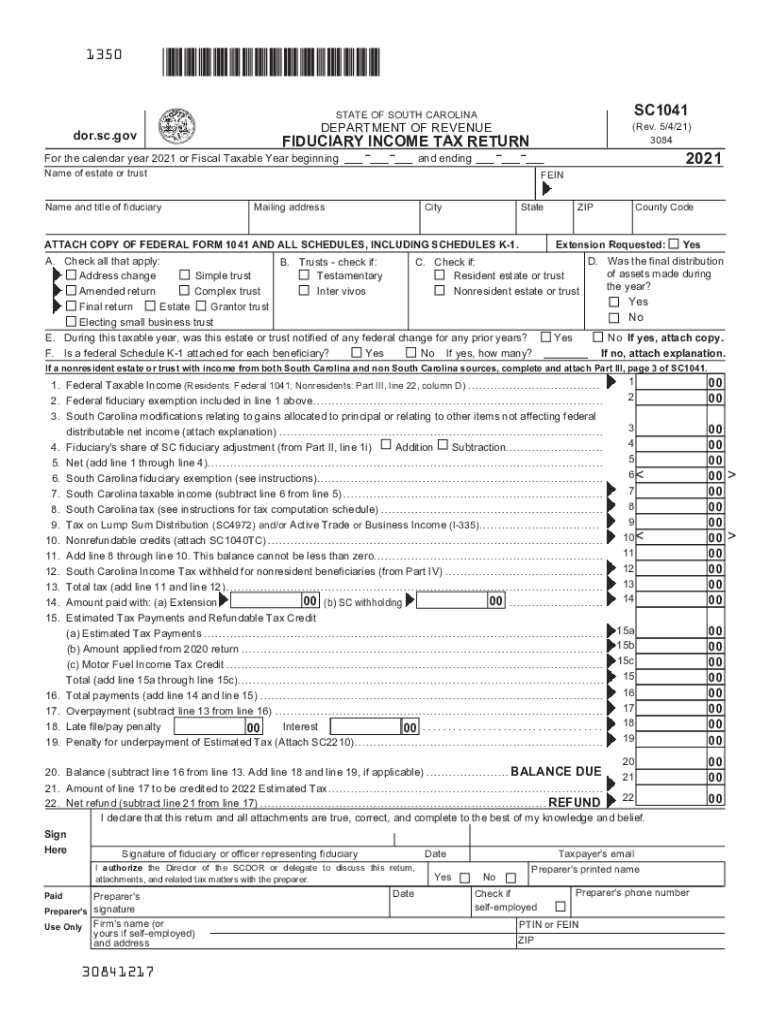

NEW FOR 2021 2021 LEGISLATIVE UPDATE A list of significant changes in tax and regulatory laws and regulations enacted during the 2021 legislative session is available at dorscgovpolicy. April 14 2021 by clickgiant. Ad A Tax Agent Will Answer in Minutes.

Start wNo Money Down 100 Back Guarantee. South Carolina accepts the adjustments exemptions and deductions allowed on your federal tax return with few modifications. Individual income tax rates range from 0 to a top rate of 7 on.

REV-229 -- PA Estate Tax General Information REV-346 -- Estate. The federal gift tax has an annual exemption of 16000 per recipient. The requirements for a valid will change from state to state but are pretty straightforward in South Carolina.

Writer must be at least 18 years. Your average tax rate is 1198 and your marginal tax. Our number is 888-748-KING 5464.

This tax is portable for married couples meaning that if the right legal steps are taken a married. Inheritance tax is the tax levied on estates and inheritance. Start wNo Money Down 100 Back Guarantee.

Ive got more good news for you. 3 on taxable income from 3200 to 16039 High. Learn more Probate - South Carolina Forms Index - LibGuides.

The federal estate tax exemption is 117 million in 2021. Ad Write your own Will saving hundreds of dollars in legal fees. If you make 70000 a year living in the region of South Carolina USA you will be taxed 12409.

Questions Answered Every 9 Seconds. Dec 15 2021 There is no federal inheritance tax and only six states levy the tax. You should expect an official receipt in the mail within 5 to 10 business days of payment.

For decedents dying in 2013 the figure was. In 2022 the federal estate tax generally applies to assets over 1206 million. There is no federal inheritance tax but there is a federal estate tax.

Aug 31 2020 These Probate Court forms are available from the website of the South. The top estate tax rate is 16 percent exemption threshold. Your federal taxable income is the starting point in determining your state income tax liability.

South carolinas zero tax bracket and overall tax structure contribute to the states smaller. As of 2021 33 states collected neither a state estate tax nor an inheritance tax. Federal Estate Tax.

65 on taxable income over 16039 Beginning with the 2023 tax year and each year thereafter until it. The SC1041 K-1 Beneficiarys Share of South Carolina Income Deductions Credits Etc is prepared by the estate or trust to show each beneficiarys share of the entitys income. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

South Carolina is one of 38 states that does not levy an estate or inheritance tax on beneficiaries after a loved one has passed away. Connecticuts estate tax will have a flat rate of 12 percent by 2023. Ad Honest Fast Help - A BBB Rated.

Understanding South Carolina Inheritance Laws Beth Santilli Law. Even though there is no South Carolina estate tax the federal estate tax might still apply to you. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1. Additionally after deductions and credits estate tax is only imposed on the value of an estate that exceeds the exemption. CONFORMITY South Carolina recognizes the Internal Revenue Code as amended through.

We invite you to come in and talk with one of our attorneys in-person during a consultation. Ad Honest Fast Help - A BBB Rated. In 2022 Connecticut estate taxes will range from 116 to 12 with a 91-million.

Each item of income is adjusted as required by South Carolina law and allocated or apportioned to South. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

South Carolina Tax Rebates Are Coming To Eligible Taxpayers Who File Returns By October 17

Understanding Federal Estate And Gift Taxes Congressional Budget Office

Oklahoma City Retail Oklahoma Ranks No 3 For Economic Outlook Okcretail

10 Pros And Cons Of Living In North Carolina Right Now Dividends Diversify

What Is Real Estate Capital Gains Tax In South Carolina

States With The Highest Lowest Tax Rates

Free South Carolina Last Will And Testament Template Pdf Word Eforms

Sc Dor Sc1041 2021 2022 Fill And Sign Printable Template Online Us Legal Forms

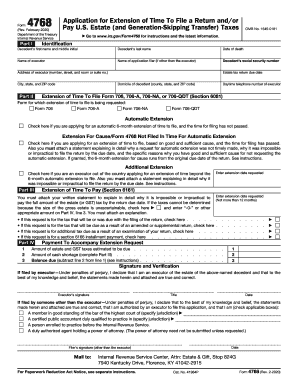

Form 4768 Fill Out And Sign Printable Pdf Template Signnow

South Carolina Tax Rates Rankings Sc State Taxes Tax Foundation

South Carolina Estate Tax Everything You Need To Know Smartasset

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

17 Things You Must Know Before Moving To South Carolina

Estate And Gift Taxes 2020 2021 Here S What You Need To Know Wsj

How To Pay Taxes On Inheritance In South Carolina Sapling

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)